[For Sale] 256 Finch Ave E

$1399880

4 Bedroom + Den

Garage: Single with 2 Parking SpacesSize: 2484

Development Level: Built

Taxes: $6,536.78 (2020)

An Absolute Show Stopper! Corner Unit Freehold Townhouse Located In Willowdale. This Beauty Features Large Windows Throughout The House Gives An Abundance Of Light W/ A Breathtaking Open Concept Layout & Soaring 9Ft Ceilings on the Main Level. Quartz Countertop W/ Marble Backsplash In Kitchen. Master Bedroom Features His/Her Closets, Ensuite Washroom and Private Balcony. Solar Powered Blinds. Built In Electrical Vehicle Outlet in the Garage. This home is ready for the future!

Conveniently Located Nearby Shopping, Restaurants, Subway, Hwy 404, Hwy 401 & More!

9 Refreshing Ways To Decorate Your Home With Plants

It's a given: plants are perfect living accessories. Aside from their many health benefits, they make fantastic home decorations because they can add so much life and color to any room or space. Having house plants is also another way to appreciate your home more.

If you'd love to accessorize your home with pretty, green foliage but need some inspiration on how to better do it, read on for these new and unique ideas. Soon thereafter, you will move on from the usual bar cart or garden rack filled with plants and come up with new ways you can spruce up your home.

Bookshelves aren't just for books, framed photos, and other displays and accessories. If you haven’t considered this yet, try including a plant or two to your bookcase to enrich the space and add some texture. If you want to go beyond the succulents or small potted plants, place a trailing plant on the top of the shelf to add a “living layer” and create visual interest.

Love plants but don't think you have any extra floor space? Well, the sky (or the ceiling) is the limit! Creating a garden in the air can instantly add a dreamy, bohemian look in your space. Also, setting up hanging planters at varying heights is an unexpected way to add color and visual interest. Hanging plants are also perfect if you have pets or small children and you’re afraid of them grabbing the plants on the floor or tabletop, especially since there are some plant varieties that could be poisonous to them when eaten.

You can opt for some macramé plant hangers if you want that boho-chic look. Or, simply use a hook on the coat rack in your entryway or mudroom to add a hanging planter as an instant accessory.

Want to try something different? Go over the top with an enormous potted tree that can add a burst of life to your space. It's perfect if you are already tired and bored of the usual small house plants, you have a minimalist home, or if you don’t have enough space or budget for lots of plants.

Tall indoor plants and trees like palm trees, fiddle leaf fig, olive tree, or Monstera, can be a great statement or conversational piece in any room. They can add so much more floor-to-ceiling style to any space. And since trees are natural, living furniture pieces, they can complete the look of the home with the most organic feel and spruce up any space that needs livening.

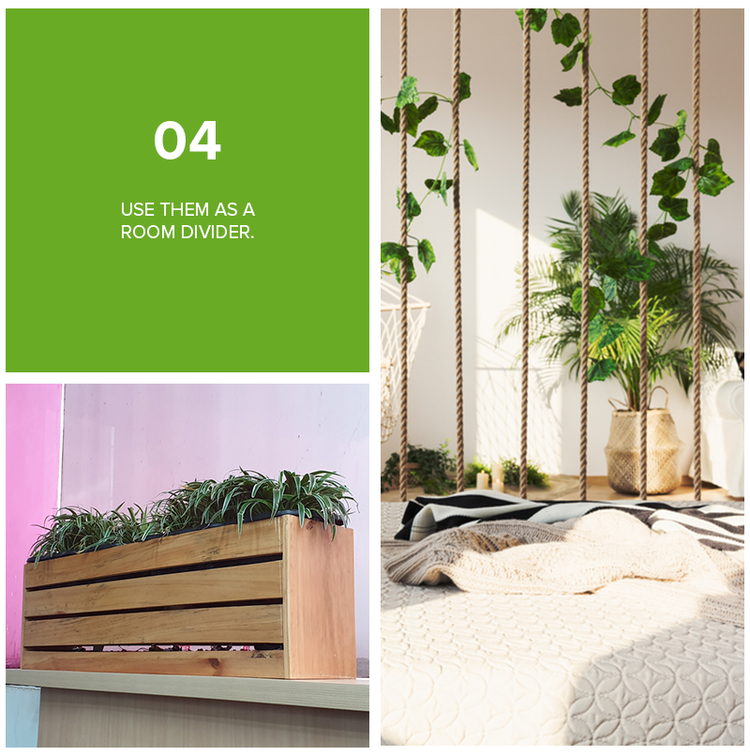

One practical way to incorporate plants into your home is to use them as a room divider. They make attractive dividers especially on houses with open floor plans or layouts, and on studio apartments where you need to create defined areas within the room. Using plants is also a great way to maximize natural light and space.

There are several ways you can craft a divider using house plants. You can use any standard open bookcase, cube storage unit, or rectangular planter between the spaces you want to separate and fill it with plants. You can also line small, similar plants on top of a long table or bench. Likewise, choose several tall planters with small trees or plants with broad or bushy leaves to create a lush screen that will add a lot of character to your open floor plan.

Plant life can pop in many areas of your home—even in your restroom. Especially if you're looking for ways to improve the look of your boring bathroom, adding a few potted plants can add a soft, warm layer to all the hard materials. Some plants that will feel perfect in a bathroom or walk-in shower include peace lily, sansevieria or snake plant, and spider plant. The bonus is, even if you think you have a black thumb, these plants will thrive in low light and warm temperatures. Also, the moisture created from your daily bath can help your leafy friend stay alive even with less effort.

Bring the pleasure of cooking with fresh herbs straight to your kitchen by growing your own indoor garden. The beauty of this is, even if you have limited outdoor space or have no room for a vegetable garden, you can incorporate plant decor while filling your home with the calming and fresh-smelling scents of herbs. Try planting basil, rosemary, mint, parsley, and thyme in small pots or even mason jars, and then mount them on black wooden boards that you can lean against your kitchen cabinets. You can also use individual planters that will add another pattern to your kitchen wall. This way, your plants will not only serve as cooking aides but also as wall art. Plus, those herbs mentioned above are just some of your best choices for your indoor garden since they don't grow too wide or tall.

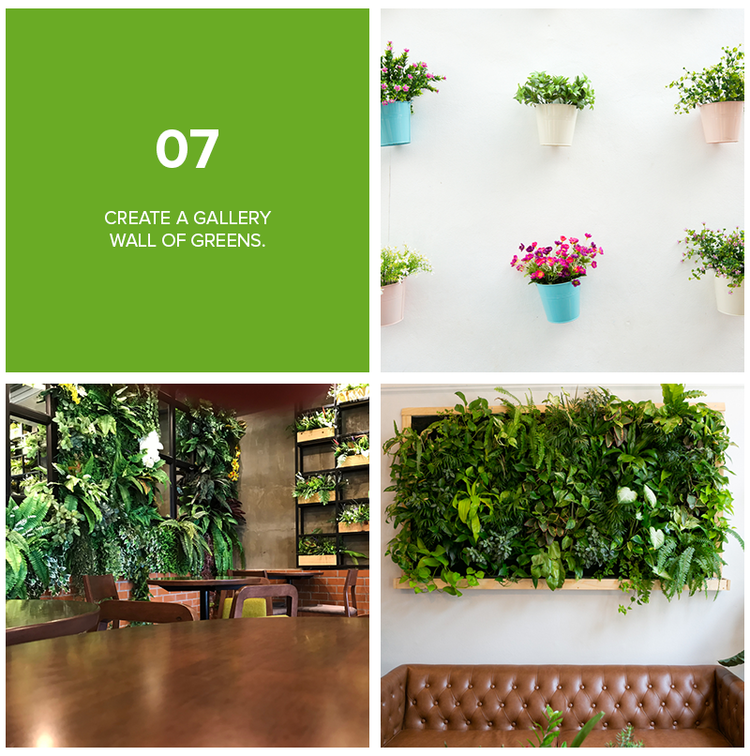

Instead of filling that bare wall with expensive paintings or photos, why not display some greenery? Creating a gallery wall of plants is another great and unexpected way to incorporate them in your home. Adding some greenery to your blank wall can instantly add color and texture to your space. If you love succulents and cacti, they are perfect to decorate your homes with using tiny planters, as they will do well indoors and can thrive in less sunlight. To combine geometry with greenery, opt for wall planters with unusual or eccentric shapes and see how they steal the attention of anyone in the room.

Mirrors can make a room look larger and feel more open. However, large mirrors can at times be distracting. To counterbalance the effect, place a few tiny plants or cute topiaries in front of it. You can use plant pots or containers that match the color of your mirror frame for a more harmonious effect.

If you have any areas in your home that look lonely and unfilled, adding different layers of plants may actually do the trick. Instead of adding a potted plant on the stairs landing, why not place some pretty foliage on the wall flanking the stairs? If you have high cabinets with an unused empty space on top, add some planters in there to create a lush backdrop.

9 Refreshing Ways To Decorate Your Home With PlantsCertainly, there are better and more innovative ways to decorate your home with plants. If you can't commit to having a mini plant sanctuary, you can always go for a few houseplants that are hard to kill and can thrive with minimal effort. Plus, plants not only make any space gorgeous, but they also have a special way of making us feel better, happy, and content just by being there.

Stop Believing These 6 Common Pricing Myths When You Sell Your Home

When you put your home on the market, the one aspect that usually comes to mind is profit. Without a doubt, every seller's main goal is to sell their home for the best possible price. However, in an effort to get the best deal possible, many sellers fall prey to myths about home pricing that don’t reflect the current real estate market.

Setting an asking price for your home will never be a walk in the park. But coming up with an accurate number can give you the biggest advantage. It can mean the difference between quickly getting an offer and risking your home to sit on the market for months, losing the interest of many potential buyers.

So if you want to get the most out of your home sale, disregard these most common myths about pricing a home and start your journey with some realistic expectations!

But here's the reality: getting an offer (or offers!) in the first few days most likely means your home was priced accurately and competitively, which attracted multiple buyers. Your home has the right price on the right market that’s why you received multiple offers even in a short amount of time.

However, that’s not how real estate works most of the time. The longer your home stays on the market, the worse the offers could get. Or maybe you’d get none at all. This is because homes sell for the most money when they are on the market for less than 30 days. According to the NAR 2018 Profile of Home Buyers and Sellers, recently sold homes were on the market for a median of three weeks. When a home has taken so long to sell, buyers will start to wonder what is wrong with it. They may assume that it was priced too high, or that there are issues with the property itself.

Your realtor knows that negotiation is very important in real estate, so trust their experience in this matter. They will price your home appropriately from the beginning but will make sure there’s enough wiggle room so you can still get what you want out of the sale.

To get an idea of which upgrades yield the biggest return on investment, check out the 2018 ‘Cost Versus Value’ report by Remodeling Magazine. For instance, you can expect to get back only 56% of the costs of an upscale bathroom remodel. Meanwhile, the projects with the biggest return include a garage door and entry door replacement.

Watch Out! These Neighborhood Features Can Drag Down Your Home's Value

While there are certain home improvements you can add to your home to boost its resale value, there are also many external factors that can devalue your greatest investment. This is why the real estate cliché saying “location, location, location” will never be debunked or even grow old. Many of the things that can dampen your home’s value can actually be found in your neighborhood.

These factors are already outside the homeowner’s control and what appraisers refer to as external obsolescence. Understanding how these external factors can influence the long-term value of your home is paramount because decreasing property value can pose a challenge when it’s time to sell your home. In the worst-case scenario, you may have to sell it for less than what you purchased it for, causing you to lose money on the table.

Bad Schools

Proximity to good quality schools is one of the most desirable factors for most home buyers. It is because neighborhoods near top-quality school districts almost always benefit when it comes to property values. However, the disastrous opposite of this is living in a bad school where there is a slim graduation rate.

Neighborhoods near low-ranking schools are less attractive to many buyers and have lower property values. According to realtor.com, the median home price of areas with schools that received a 1 to 3GreatSchools.org Summary Rating is only $155,000. Repeatedly, there will always be a better demand for homes in good school districts.

Disruptive Neighbors

Don’t be surprised if noisy and disruptive neighbors can significantly reduce nearby home values. According to The Appraisal Institute, the nation’s largest professional association of real estate appraisers, a home’s proximity to a bad neighbor can impact the rate of potential decline in property value. Those “bad neighbors” include homeowners with unkempt yards, homes with unpleasant odors and poorly maintained exteriors, or own annoying dogs that are barking at night. Living near a troublesome neighbor can devalue your home by as much as 5-10%. If you’re a home buyer, it’s important to learn what is going on in the neighborhood before you sign the dotted line.

Excessive noise pollution—especially if your home is near an airport, train tracks, or highway

Ah, noise pollution. While you can learn to live with it, it is not a desirable factor for most buyers. If you live near an airport, train tracks, a highway, a loud factory, or near an industrial area where there is constant noise and you need to endure it every day, it can be a negative factor when it’s time for you to sell your property. The louder the noise and the more inconvenient it is, the more negative its impact could be on your home’s resale value.

If your home is located next to train tracks, it can deter buyers from purchasing it because they have to deal with the noise at various hours of the day. You will have the same scenario if your property is located on top of a freeway. While it is ideal to live near commuting routes, homes located adjacent to major highways have lower values compared to identical homes far from freeways. Ask your local real estate agent how much of an impact those nearby transportation facilities have on reducing your home’s market value.

Proximity to power lines and power plants

Having a power plant in the neighborhood is generally associated with lower property prices because of safety concerns. Likewise, having power lines near your home is also not a good thing. They are vital, yes, because they bring much-needed electricity that helps us live our modern life. But they are also unattractive and imposing. The perceived negative health effects of living near power lines can also make people worry so they may not purchase a home near one.

However, if you’re still planning on buying a home near power lines, it’s best to consult with your local real estate agent to know how much impact it will have on your home’s market value. There may be a reason for the low price so think carefully if it will be a good bargain.

Proximity to a cemetery

A graveyard next door can make many people uncomfortable. Some may even find the prospect of living near a cemetery downright terrifying. It isn’t surprising since cemeteries represent mortality so living next to one may not be ideal to many. And while there are certain pros and cons of living in proximity to those graves (just think how quiet your neighbors are), not all people can accept that. Research by realtor.com that used a list of federal and state cemeteries operated by the Department of Veterans Affairs, they found out that the median home price in ZIP codes with a cemetery is about 12% lower than similar homes in other neighboring areas without a graveyard. Many people also find it disturbing to witness a handful of funerals each year and see the road being lined up with cars of mourners.

Near a shooting range

While having a gun range nearby can be beneficial to some people because they can take part in such a hobby, a shooting range right next door can actually drag down your home’s value by 3.7%. If you’re looking to buy a home, think twice about purchasing one near shooting ranges. The noise of gunfire, especially from outdoor gun ranges, can be loud and disturbing. There are also environmental and safety concerns since the lead that leached out of spent shells might poison the soil and water. If you’re considering a home near a gun range, research the shooting schedule of the place and figure out whether you can tolerate hearing gunshots now and then.

Billboard/s near the home

Studies have shown that billboards also impact real estate prices. In urban areas where billboards stood near residential homes, the closer the billboard is to your home, the more it can lower its value. This is why many communities are implementing a no-billboard policy or enforcing strict billboard controls to protect home values and promote higher median incomes and lower home-vacancy rates.

Multiple foreclosures in the area

Multiple foreclosures in your neighborhood can also affect the resale value of your home. Foreclosures imply that something is wrong with the area, so they can be eyesores that can easily drag down the average home values. And since a bank-owned home is less likely to be properly maintained, they can also translate to unsightly yards with stubborn weeds taking over the lawn and poorly maintained exteriors prone to vandalism and deterioration.

According to studies have shown that living within a quarter-mile radius of a foreclosed home can cause a 4% decline in property values. A report by The Alliance for a Just Society also found that aside from a significant decline in the value of surrounding properties, areas with foreclosures also experienced an increase in property taxes.

Who Cares if the Ground Hog got it right, Spring is STILL Coming. I promise.

Spring is Springing! Yay! I just came inside from shooting a video outside and WOW! It’s nice out! Yes, I realize that when you get this and read it that it could be cold and rainy, but those cold days are just about over. Everyone loves Spring, primarily because it means… summer is near!

For many across this great country though, it’s still COLD, grey, and snowy! One thing is for sure, this winter season is coming to an end. It does every year without fail.

Just like the weather seasons come and go, so do the seasons of life. I just turned 35, my youngest just turned 7 months, and my oldest is adventurous exploring what toddlers do best. Are you with me when I say that these seasons seem to come and go faster and faster as well as the time?

Some of life’s seasons will be HOT and others will be COLD, some high and some low. The lows we want to move by quickly, the highs we want to stay in forever. But it’s the low points, those tough times, that I have learned the most from. All of the experiences through these seasons make me who I am.

So, what does this have to do with you and real estate?

Spring is a time of action, a heating up of the desire for a new place to call home for many. Maybe you or someone you know is right now looking or considering it. That’s great! We are here to help with that. Whether it be a list of the 10 best buys matching home buying criteria or delivering top dollar on a home sale along with our written guarantee of the asking price, our award-winning SYSTEM and TEAM are eager to help.

Unfortunately, there are some that will have a Spring Time they would much rather forget.

We are on a mission to raise $50,000 for Rozaay Books Sneaker Drive. We do this by donating to them a portion of our income from the homes we sell. The goal is to empower children and youth for the real world. This is done through a series of free events such as workshops, clinics, panels and many more initiatives that give the next generation access to new world information and help with self-discovery.

If you or anyone you know is considering selling, give me a call or pass on my number. Thank you in advance for your referrals! My number is 647-308-9000.

Thank you for reading over this month's Homeward Bound, and thank you for referring anyone you know considering buying or selling to my team. They will be in good hands and a very worthy cause will benefit as well.

Michael Lau

Townsend Team Real Estate

647-308-9000

How To Sell a House That Didn’t Sell

If your home has just come off the market and hasn't sold, don't be discouraged. The reason your home did not sell may have nothing to do with your home or the market. In reality, your home may have been one of the more desirable properties for sale.

So Why Didn't Your Home Sell? Last year many of the homes listed for sale never sold at all, and many sellers found that there was a tremendous amount a homeowner needed to be educated on to sell their home for top dollar in the shortest time period.

Don't risk making the wrong choices and losing both time and money on your investment. Before you hire a realtor, know the right questions to ask to save you time and money.

Industry experts have prepared a free special report called "How to Sell a House that Didn't Sell" which educates you on the issues involved.

Q. Where should you begin?

A. Start by making a commitment to do what it takes to market your house to get it sold. With the right system, the home sale you want is still well within reach.

Q. Why didn’t your home sell?

A. Review your previous selling plan and you’ll discover that an expired listing usually reflects a problem in one or more of these four major areas:

- Teamwork

- Pricing

- Condition of Your Home

- Marketing

Why Don’t Some Houses Sell?

Here are 2 out of the 4 Important Points That Will Get Your House Sold!

1. Teamwork

Your home is a major financial investment, and your relationship with your Realtor® should be a full partnership where your needs and wishes are heard, and you receive detailed and dependable feedback on the progress of your sale. Your agent has a responsibility to source this feedback from the agents who have shown your home, and to communicate this to you so together you can make the right decisions about what to do next. How well did this occur the last time you had your home up for sale?

2. Pricing

Did the price work for or against you? The “right” price depends on market conditions, competition and the condition of your home. Pricing it too high is as dangerous as pricing it too low. If your home doesn’t compare favorably with others in the price range you’ve set, you won’t be taken seriously by prospects or agents.

You’ll get the facts when you see the statistics!

So there are 2 out of the 4 reasons to get your home sold! If you'd like to see all 4 of the tactics to get your home sold, you can grab a copy of that report for free by sending me an email to michael@callmikelau.com or call/text me at 647-308-9000.

Thank you for reading this weeks blog.

Michael Lau

P.S. Your Home Sold Guaranteed or I’ll Buy It!* If you or anyone you know is considering making move in the next few months, give me a call or pass on my number…. 647-308-9000

11 Critical Home Inspection Traps to be Aware of Weeks Before Listing Your Home for Sale

According to industry experts, there are over 33 physical problems that will come under scrutiny during a home inspection when your home is for sale. A new report has been prepared which identifies the eleven most common of these problems, and what you should know about them before you list your home for sale. Whether you own an old home or a brand new one, there are a number of things that can fall short of requirements during a home inspection. If not identified and dealt with, any of these 11 items could cost you dearly in terms of repair. That's why it's critical that you read this report before you list your home. If you wait until the building inspector flags these issues for you, you will almost certainly experience costly delays in the close of your home sale or, worse, turn prospective buyers away altogether. In most cases, you can make a reasonable pre-inspection yourself if you know what you're looking for, and knowing what you're looking for can help you prevent little problems from growing into costly and unmanageable ones.

Here are 4 of the 11 that you should know about right now.

1. Defective Plumbing

Defective plumbing can manifest itself in two different ways: leaking and clogging. A visual inspection can detect leaking, and an inspector will gauge water pressure by turning on all faucets in the highest bathroom and then flushing the toilet.

If you hear the sound of running water, it indicates that the pipes are undersized. If the water appears dirty when first turned on at the faucet, this is a good indication that the pipes are rusting, which can result in severe water quality problems.

2. Damp or Wet Basement

An inspector will check your walls for a powdery white mineral deposit a few inches off the floor and will look to see if you feel secure enough to store things right on your basement floor. A mildew odor is almost impossible to eliminate, and an inspector will certainly be conscious of it.

It could cost you $200-$1,000 to seal a crack in or around your basement foundation depending on severity and location. Adding a sump pump and pit could run you around $750 - $1,000, and complete waterproofing (of an average 3 bedroom home) could amount to $5,000-$15,000. You will have to weigh these figures into the calculation of what price you want to net on your home.

3. Inadequate Wiring & Electrical

Your home should have a minimum of 100 amps service, and this should be clearly marked. The wire should be copper or aluminum. Home inspectors will look at octopus plugs as indicative of inadequate circuits and a potential fire hazard.

4. Poor Heating & Cooling Systems

Insufficient insulation, and an inadequate or a poorly functioning heating system, are the most common causes of poor heating. While an adequately clean furnace, without rust on the heat exchanger, usually has life left in it, an inspector will be asking and check- ing to see if your furnace is over its typical life span of 15-25 yrs. For a forced air gas system, a heat exchanger will come under particular scrutiny since one that is cracked can emit deadly carbon monoxide into the home. These heat exchangers must be replaced if damaged - they cannot be repaired.

So there are 4 out of the 11 in an effort to draw attention to this very important topic. If you'd like to see all 11 of the most common inspection traps I have put together a free report entitled *11 Things you need to know to pass your home inspection" which explains the issues in greater detail. You can grab a copy of that report for free by sending me an email to michael@callmikelau.com or call me at 647-308-9000.

Thank you for reading this weeks blog.

Michael Lau

P.S. Your Home Sold Guaranteed or I’ll Buy It!* If you or anyone you know is considering making move in the next few months, give me a call or pass on my number…. 647-308-9000

International Buyers Guide

Foreign Ownership

As of April 21, 2017, any individual who is not a Canadian citizen or permanent resident of Canada (including corporations and trusts) is subject to a Non-Resident Speculation Tax of 15% of the purchase price (paid at closing) for properties purchased in Toronto, Brant, Dufferin, Durham, Haldimand, Halton, Hamilton, Kawartha Lakes, Niagara, Northumberland, Peel, Peterborough, Simcoe, Toronto, Waterloo, Wellington and York.

Financing

While Canadian lenders do finance the home purchases of non-residents, they usually require significantly larger down payments. Most of our non-resident clients are required to have a 35% downpayment. Lenders will require you to verify your income and creditworthiness and prove that you can pay the mortgage. Also, mortgage interest rates may be higher than what Canadian residents would pay (though in our experience, they are still very attractive rates). It’s important to connect with a mortgage broker or your financial institution to find out your qualifications.

Taxes

As with any investment, it’s important to contact your accountant to understand fully how the purchase or sale of a property in Canada will affect you from a tax perspective. The following is meant to be a guideline only:

Non-Canadian citizens and non-permanent residents of Canada buying a property in the Toronto region must pay a 15% tax on closing.

When buying a property in Toronto, foreign buyers pay the same land transfer taxes as Canadian residents. First time home buyers who plan to use the purchase as their primary residence may be eligible for land transfer tax rebates.

There are also tax implications for non-residents when selling a property. There are forms, processes, and penalties for not complying with the Canada Revenue Agency (CRA)’s rules.

Insurance

It’s sometimes difficult (and more expensive) for non-residents to obtain insurance for an investment property. Given that proof of home insurance is required to obtain a mortgage, this is an important factor to consider. If you’re looking to buy a Toronto investment property, make sure to get insurance quotes and information before making an offer.

Making an Offer

In this day and age, signing the legal documents to make an offer on a house or condo can be done digitally, and with Skype and Facetime, it’s easy to get the same price advice and information from your REALTOR that you’d get if you were physically in Toronto. Many lenders require a foreign buyer to sign the mortgage paperwork in person (though this can be avoided with an executed Power of Attorney).

Choosing a REALTOR

Look for a real estate agent who has experience selling properties to non-Canadians and can refer you to property managers, lawyers and appropriate lenders for your circumstances. If you’re looking to buy a Toronto property while overseas (vs. during a trip to Toronto) look for a REALTOR who is experienced in previewing properties for absentee clients and who is familiar with the tools and technology (especially video) to ensure a smooth process.

We work with a lot of overseas clients and have perfected a process to video and communicate with our buyers about potential properties to eliminate the need to be physically in Toronto to choose a property to buy. We have a dedicated team of lenders, lawyers, and insurance brokers who help our non-resident Buyers in Toronto.

Steps to Buying a Home

Buying a home can be overwhelming. You could be a first time home buyer, investor, moving up to a bigger home, this guide will help you through all the steps.

- Get pre-qualified for a mortgage. Talk to mortgage brokers, banks, etc.

- Go online and view homes in person.

- Make an offer, be ready for negotiations and possibly bidding wars

- Know your closing costs

Financing

Don’t search blindly. The biggest mistakes i’ve seen is buyers think they know what their budget is when really their purchasing power might be much higher or lower. By doing this as your first step, you can potentially save yourself thousands and hours. Get Pre-Qualified!

Step 1 – Get Pre-Approved for a Mortgage

The first step to buying a house or condo in Toronto or anywhere in the world should be finding out how much your bank is willing to lend you. When you pre-qualify for a mortgage, your lender will look at your income, your debts, your credit history, and your down payment. This mortgage pre-approval is usually valid for 90 to 120 days which includes an interest guarantee.

One thing to note, a pre-approval is not a guarantee that a lender will lend you a certain amount of money for any home. Lenders want to know that the home they are purchasing with you (by lending you the money) is worth what you paid. Banks generally require an appraisal of a home before they advance the mortgage money.

Getting pre-approved will ensure that you know how much mortgage you can get, which in turn will help you know what price range of homes you should be targeting in your search. It allows you to focus your house-hunting efforts and eliminates the risk and uncertainty of financing once you find your perfect home.

Step 2 – Mortgage Decisions

Mortgages can seem intimidating, especially for first-time buyers. Once you’ve qualified for a mortgage, there are some basic decisions you will have to make before you take possession of your house or condo: Mortgage term, amortization, interest rate and type of mortgage. Your mortgage broker should be able to help you guide you through all the different types of mortgages.

Mortgage Term and Amortization

The mortgage term and amortization period affect the amount of money you can borrow (and thus the price of the home you can buy), and dictate how much your monthly payment will be.

Mortgage term

This is the amount of time a lender will loan you money for – typically from 6 months to 5 years. When the term is up, the remaining amount is payable in full unless you arrange new financing for another term.

Amortization

The longer the amortization period, the lower your individual payments will be – but this also means you’ll be paying more in interest. Lenders calculate or amortize, the mortgage payments over a much longer time, often as long as 30 years.

Payments

Most mortgage payments consist of two parts: principal and interest. Each payment reduces the balance owed on the mortgage by the portion of the payment that is credited to the principal. Over time, the proportion of your payment that reduces the principal balance will increase. The faster you can pay down the remaining balance, the less total interest you’ll pay. There are many ways you can pay down your mortgage faster, from accelerating your payments (e.g. paying biweekly instead of twice a month, for 26 payments per year instead of 24) to making lump sum payments on your mortgage; your lender can help define the right strategy for you.

Interest Rates

The interest rate is one of the biggest contributing factors to how much you end up paying for your home, both on a monthly basis and over the life of your mortgage. Interest is the cost of borrowing money. Interest rates fluctuate with the economy. The interest rate you commit yourself to at the beginning of the term can have a significant effect on the amount you pay each month for your mortgage. There are two basic types of interest rates used in mortgage products: fixed-rate and variable-rate:

Fixed-rate mortgage – Essentially, this means committing to a single interest rate that will not change for the term of your mortgage. This strategy locks in how much of your monthly payment repays the principal vs. going to interest. Fixed-rate mortgages are great in an economy where interest rates are going up, as you never have to risk paying higher interest rates.

Variable-rate mortgage – There are two types of variable-rate mortgages. With the first kind, the amount of your monthly payment fluctuates with the bank’s prime interest rate – if rates go up, your payment increases; if rates go down, your payment decreases.

Step 3 – Choose a Lender

There are many types of lenders and mortgages out there. It’s a good idea to talk to at least three lenders:

- Your own bank. They have your bank accounts, credit cards and investments so they should be motivated to give you a good rate.

- A mortgage broker. Mortgage brokers work with a lot of different lenders and will go to them on your behalf to find the best mortgage rate and terms. Usually, broker fees are paid by the banks, so it’s a good way to comparative shop without having to do all the leg work yourself.

Househunting

This is the fun part! Almost everyone I meet now spends time searching for properties online and attending open houses! The dream of yours forever home!

First Things First – Develop your Wish List

There are over 100s of criteria out there when searching for a home. You need to create a list of what you want and what you need. How many bedrooms do you need? Open Concept? Separate Entrance? Location? Almost everyone needs to compromise on something, and it usually comes down to 3 things: size, location, and price.

What’s most important to you? Would you rather live in a bigger house or closer to downtown? Are you OK spending more money for a renovated house or could you buy a cheaper house and do the renovations yourself? Would you consider living on a busy street to more affordably be in a better neighborhood with access to better schools?

Step 2 – Pick Your Team

This will likely be the biggest purchase you’ll ever make! Don’t worry, you don’t need to do it alone. There are professionals who will be able to help you throughout the process. You will need a lender/mortgage broker who will guide you through your financing options, a lawyer to help with reviewing legal documents, and a real estate agent who will help ease your search process. There are thousands of professionals out there, so ask your friends and family for recommendations, do your research and don’t be afraid to interview multiple people.

Step 3 – The Search

94% of Canadians search for their homes online.

Tips for looking for a home online:

- Unfortunately, photos are not always a representation of what the home actually is.

- Descriptions can be overly exaggerated to sell the property.

- Asking prices of the home may not always be what the market value of the home. In a hot market, often homes sell for more than the listing price.

- If you’re shopping for a condo, keep in mind that what’s included in the maintenance fees varies from building to building, so it isn’t easy to compare condos. A lower maintenance fee might still mean more monthly costs if it doesn’t include heat and electricity.

Step 4 – House Hunting in Real Life

You can visit homes for sale in real life with your real estate agent or by attending an open house. Keep in mind that not all properties will have open houses, so working with a real estate agent you trust the only way to guarantee that you’ll be able to see the houses or condos you want to see (and on your schedule!).

Tips for looking at homes in real life:

- Toronto is a big city, and if you’re like most people, you have a few target neighborhoods. Try to focus on one neighborhood at a time.

- Wear slip-on/slip-off shoes. Seriously. You’ll be taking your shoes off dozens of times, so save yourself the hassle of lace-up shoes.

- Don’t just focus on the house or condo, focus on the neighborhood. Drive around the neighborhood. Locate the schools, parks and grocery stores. Take a walk down the street and check out the neighbors. Make a point of going to a cafe, restaurant or pub in the area.

- Vary the time of day that you house hunt. Everything looks better when the sun is shining, but it’s important to get a feel for the house or condo and the neighbourhood during the day AND at night.

- Experience the bad with the good. Every neighbourhood has its drawbacks, so make a plan to experience them. Thinking of buying a house near the railroad tracks? Check it out during rush hour when most of the trains are running.

- Take notes and photos. It’s surprising how quickly you can forget the first house or condo you saw.

- See past the gross. You’ll probably be surprised to find out how some people live, but don’t let someone’s bad decorating styles, outdated tastes and lack of housekeeping get in the way of finding your perfect Toronto house or condo.

- Don’t fall in love with the seller’s stuff. This happens all the time and that beautifully staged condo won’t look nearly as great with all your IKEA stuff in it. Try to imagine your furniture and style.

How I can help with your search?

- I will help you match what you want with the greatest opportunity for ROI. Together we’ll examine your needs, wants and must-haves to create a picture of your ideal home or investment property.

- I will stay on top of new properties in the best Toronto neighbourhoods as they come on and off the market. We’ll send you daily listings of what’s available and monitor what’s happening, as it happens.

- I will be your house-hunting partner on YOUR schedule. We can take you to see any property that’s for sale and sometimes even ones that aren’t.

- I can save you time. We can preview properties on your behalf and screen what is or is not for you, saving you time and hassle. I can send you video profiles of what we’re seeing – or better yet, you can follow us streaming live on the web.

Making an Offer

You have found the home you want! The offer process is both exciting and nerve-wracking. We begin by drafting the Agreement of Purchase and Sale. This is a legally binding document which contains everything from the price you are prepared to pay, to the inclusions you want (washer/dryer, big screen TV), to your ideal closing date (the date you take possession), to conditions that need to be met for the deal to go through. Once you’ve submitted your offer, the seller can accept it, reject it or sign back a counter offer. During these back-and-forth negotiations, you may need to compromise on small things, but a good real estate agent will work hard to get you what you want. And if you’re in a bidding war, make sure you know the facts about Bidding Wars and How to Win in Multiple Offers.

Meet Conditions and Provide Deposit

Conditions are requirements within the Agreement of Purchase and Sale that must be met for the deal to go through. These are the most common conditions which you might include: financing condition, lawyer review of the status certificate in a condo, or a home inspection. And of course, you’ll need to submit a deposit–in Toronto, typically around 5% of the purchase price, which is held in trust until close. Once the conditions have been met, the agreement is firm, and now it’s just a matter of waiting for your closing date.

Closing

Once you have a firm deal (both you and the seller have agreed on price and agreement terms, you’ve submitted a deposit, and there are no more conditions to waive), the closing process starts. This will require you to be in close contact with your lender and your lawyer – they’ll need lots of information, and of course, money, from you.

The few days before you take possession are the most critical – you’ll need to sign a lot of paperwork, provide a certified cheque for the balance owing and of course, pick up your keys.

Closing is the point at which the ownership and possession of the property are transferred from the Seller to you. It takes place after all legal and financial obligations have been met. Closing the purchase will be a team effort: in addition to yourself, your lawyer and your lender will all be involved in helping close the deal.

Costs of Buying a Home

Some of the things you can expect to pay are:

- Down payment (less any money you have already provided as a deposit)

- Land transfer taxes (If you buy a property in Toronto, you will need to pay a municipal land transfer tax in addition to the land transfer tax in Ontario, click here to calculate)

- Lender fees, if applicable (appraisal fees, application fees, etc.)

- Adjustments (the seller may have pre-paid taxes, utilities or other expenses past the closing date which you will need to reimburse during the closing process)

- Legal fees (plus applicable taxes)

Your lawyer will calculate the final amount owing, and you will need to provide him/her with a certified cheque for the full amount before the property comes into your possession.